45L Tax Credits

In pursuing a sustainable and energy-efficient future, Energy Star tax credits emerge as a significant incentive for homeowners and builders. These credits, designed to promote environmentally conscious practices, offer financial rewards for those embracing energy-efficient solutions. This summary provides a comprehensive guide to understanding and leveraging Energy Star tax credit opportunities for Builders.

New Energy Efficient Homes by Builders:

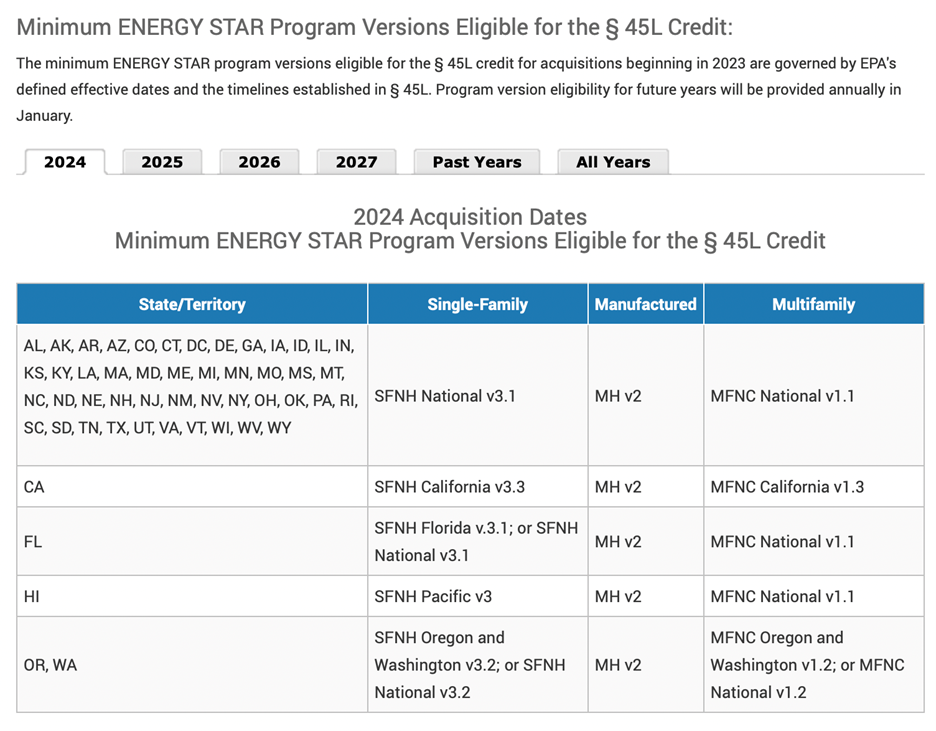

We’re excited to share that the Section § 45L New Energy Efficient Home Credit (§ 45L credit) has been renewed and expanded until 2032 under the Inflation Reduction Act (IRA). Effective January 1, 2023, eligible homes and apartments (referred to as dwelling units in § 45L) can now qualify for tax credits by meeting the certification standards of specified ENERGY STAR programs.

In line with these changes, the Internal Revenue Service (IRS) released Notice 2023-65 on September 27, 2023, offering detailed guidelines for taxpayers seeking to leverage the § 45L credit as amended by the IRA. This notice outlines the minimum ENERGY STAR program versions eligible for the credit, summarizes available credits, highlights key points from the IRS guidance, and outlines ENERGY STAR policies relevant to the § 45L credit.

Individuals or entities interested in claiming the credit are encouraged to seek advice from a tax professional. They can explore how to qualify for the tax credit and ascertain its compatibility with other tax incentives or Federal programs. Let’s make energy efficiency work for you.

Available Tax Credits for ENERGY STAR Certification:

- Single-Family Homes – $2,500 available for homes certified to eligible ENERGY STAR Single-Family New Home (SFNH) program requirements.

- Manufactured Homes – $2,500 available for homes certified to eligible ENERGY STAR Manufactured Home (MH) program requirements.

- Multifamily Homes – $500 available for homes certified to eligible ENERGY STAR Multifamily New Construction (MFNC) program requirements, with a larger tax credit ($2,500) available when prevailing wage requirements are met.

Single Family Homes:

Manufactured Homes:

Multifamily Homes:

A larger tax credit is also available for homes certified to DOE’s Zero Energy Ready Home (ZERH) Program.

Department of Energy's Zero Energy Ready Home (ZERH) Program:

Every DOE Zero Energy Ready Home adheres to stringent efficiency and performance standards outlined in the DOE Zero Energy Ready Home National Program Requirements. The program is open to various types of new homes across the United States, allowing them to participate and excel in energy efficiency. These homes undergo thorough verification by qualified third-party professionals as part of the certification process.

Provide links to DOE documents*